Introduction

Inheritance Tax UK 2025 (IHT) rules are in flux as the government seeks more revenue. With an Autumn Budget 2025 on the horizon, UK-domiciled individuals – especially those with family businesses – face uncertainty. Currently, each individual has a £325,000 nil-rate band (NRB) (frozen since 2009) and an additional £175,000 residence nil-rate band (RNRB) if a home is left to direct descendants (Simmons & Simmons, n.d.).

These combine to allow £500,000 per person (£1 million per couple) to pass tax-free, with any excess taxed at 40% (Simmons & Simmons, n.d.).

Crucially, business owners can leverage Business Property Relief (BPR) – potentially 100% inheritance tax relief on qualifying business assets – to shelter family businesses from IHT (GOV.UK, 2024a). The result is that, under current rules, relatively few estates pay inheritance tax (under 4% of deaths) (Economics Observatory, 2023).

However, rising asset values and frozen allowances are dragging more families into the inheritance tax net (Clarke Wright, 2024). IHT receipts hit £8.2 billion in 2024–25 (up £750 million year-on-year) (Clarke Wright, 2024), a record haul. With a potential £50 billion fiscal shortfall to fill, the Chancellor (Rachel Reeves) is eyeing inheritance tax reforms (Clarke Wright, 2024; Bishop Fleming, 2024). Acting now – before rules tighten – could preserve today’s generous reliefs and mitigate future tax bills.

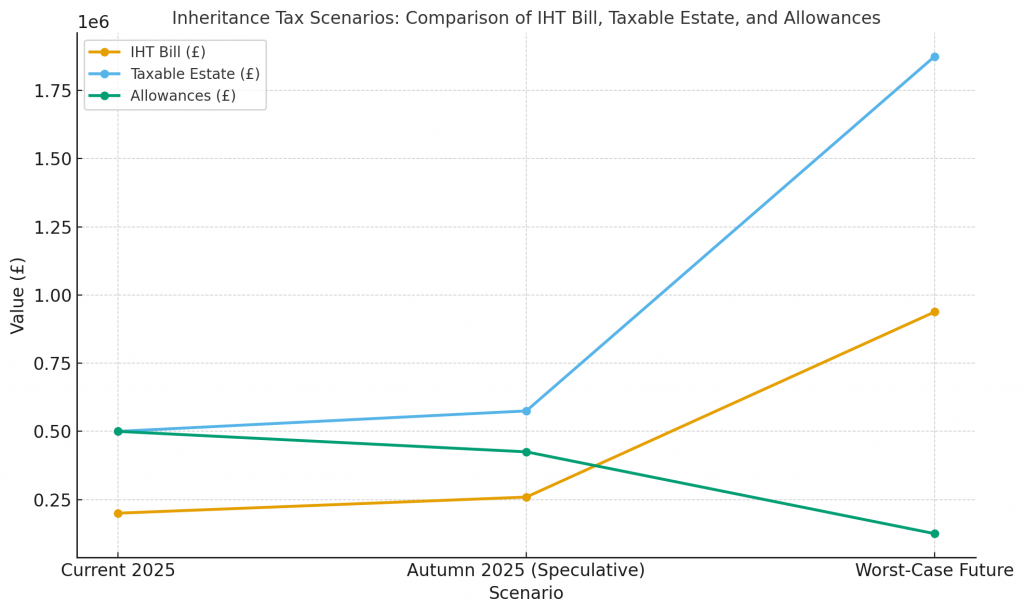

This guide explores estate planning strategies under three scenarios: the current inheritance tax rules, potential Autumn Budget 2025 changes, and a worst-case future where reliefs are scrapped. Each scenario highlights how to reduce inheritance tax legally in the UK.

Scenario 1: Current Inheritance Tax Rules (Inheritance Tax UK 2025)

Under current law, inheritance tax is charged at 40% on the value of an estate above the available thresholds (Prestige Legal Services, 2024).

Key Features of Current IHT Planning Rules

Nil-Rate Band (NRB) – £325,000 per individual can be passed on tax-free (Simmons & Simmons, n.d.). This inheritance tax allowance has remained fixed since 2009 (Shakespeare Martineau, 2024), dragging more families into the IHT threshold each year. A married couple can combine allowances, leaving £650,000 tax-free (Economics Observatory, 2023).

Residence Nil-Rate Band (RNRB) – Up to £175,000 extra allowance when a primary residence is left to children or grandchildren (Simmons & Simmons, n.d.). This boosts the inheritance tax threshold to £500,000 per person (£1 million per couple).

Business Property Relief (BPR) – Qualifying business assets can be passed on with 50% or 100% relief (GOV.UK, 2024a). This inheritance tax planning relief ensures many family businesses are passed on intact.

Example: Estate Worth £2 Million

A widower with a £1 million family business, £500,000 home, and £500,000 savings:

- BPR exempts the business (GOV.UK, 2024a).

- NRB + RNRB protect £500k (Simmons & Simmons, n.d.).

- Remaining £500k taxed at 40% = £200k IHT.

| Table 1: Current Scenario – Estate Tax Calculation | ||

| Estate Component | Amount | Tax Treatment (2025 rules) |

| Family business | £1,000,000 | 100% BPR – £0 taxed (GOV.UK, 2024a) |

| Home + other assets | £1,000,000 | Counts toward estate value |

| Less: NRB (£325k) + RNRB (£175k) | £500,000 | £500k inheritance tax allowance (Simmons & Simmons, n.d.) |

| Taxable estate after reliefs | £500,000 | Taxed at 40% inheritance tax rate (Prestige Legal Services, 2024) |

| IHT due | £200,000 | 40% of £500k = £200k |

Scenario 2: Potential Autumn Budget 2025 Changes

Chancellor Rachel Reeves has signalled that “tough decisions” will be needed (Prestige Legal Services, 2024). Analysts expect reforms to inheritance tax rules, allowances, and reliefs.

Threshold Cuts: NRB could fall to £250k (Streets Chartered Accountants, 2024). RNRB might be scrapped for larger estates (SW Group, 2024).

Business Property Relief: From April 2026, only the first £1m of business/farm assets gets 100% BPR; above that, 50% (Simmons & Simmons, n.d.). AIM shares will also be restricted.

IHT Rate Increase: A higher inheritance tax rate of 45–50% for large estates has been suggested (Streets Chartered Accountants, 2024).

Lifetime Gifting Restrictions: Proposals include capping tax-free gifts at £100–200k or extending the survival period to 10–14 years (Clarke Wright, 2024; Hurst Accountants, 2024).

Example: Estate Worth £2 Million

Assume: NRB cut to £250k, RNRB £175k, 45% IHT rate.

- Allowances: £425k.

- Business exempt at £1m (Simmons & Simmons, n.d.).

- Taxable estate = £575k.

- IHT = 45% = £259k.

| Table 2: Example Outcome – Potential 2025 Budget Changes | ||

| Item | Current Law | Post-Budget 2025 |

| Nil-rate band (NRB) | £325,000 (Simmons & Simmons, n.d.) | £250,000 (Streets Chartered Accountants, 2024) |

| Residence NRB | £175,000 (Simmons & Simmons, n.d.) | £175,000 |

| Total per-person allowance | £500,000 | £425,000 |

| Business Property Relief | 100% relief (GOV.UK, 2024a) | 100% within £1m (Simmons & Simmons, n.d.) |

| IHT tax rate | 40% (Prestige Legal Services, 2024) | 45% (Streets Chartered Accountants, 2024) |

| Taxable estate | £500,000 | £575,000 |

| IHT due | £200,000 | £259,000 |

Implications: Even moderate reforms raise tax bills. Families should review wills, trusts, and gifting strategies before April 2026 to lock in current inheritance tax planning reliefs.

Scenario 3: Worst-Case Future Inheritance Tax Changes

A drastic tightening could include:

- NRB slashed to £125k, RNRB abolished (SW Group, 2024).

- Business Property Relief removed entirely (Economics Observatory, 2023).

- Inheritance tax rate raised to 50% (Prestige Legal Services, 2024).

- Lifetime gifts taxed immediately (Shakespeare Martineau, 2024).

Example: Estate Worth £2 Million

- Allowance: £125k.

- No BPR.

- Taxable estate = £1.875m.

IHT at 50% = £938k.

| Table 3: Comparison of Scenarios | ||||

| Scenario | Allowances | BPR Relief | IHT Rate | IHT Bill |

| Current 2025 | £500k (Simmons & Simmons, n.d.) | 100% (GOV.UK, 2024a) | 40% (Prestige Legal Services, 2024) | £200k |

| Autumn 2025 | £425k | 100% within £1m (Simmons & Simmons, n.d.) | 45% (Streets Chartered Accountants, 2024) | £259k |

| Worst-case | £125k | 0% | 50% (Prestige Legal Services, 2024) | £938k |

Implications: In this scenario, nearly half of an estate could be lost to tax, forcing family businesses to sell assets just to cover inheritance tax.

And Finally...

Inheritance tax in the UK is at a crossroads. Current rules allow families to pass on homes and businesses with limited tax exposure, thanks to allowances and Business Property Relief. But with frozen thresholds and rising receipts, the government is targeting wealth transfers.

Autumn Budget 2025 could introduce inheritance tax reforms – reducing allowances, tightening reliefs, and raising rates. A worst-case future could remove reliefs entirely, pushing inheritance tax bills towards 50%.

The good news: IHT changes are rarely retroactive (Clarke Wright, 2024). Acting now – gifting, restructuring, succession planning, or using trusts – secures today’s allowances. Estate planning strategies taken early can make the difference between a £200k bill and nearly £1m.

For individuals and families, the message is clear: review your estate plan now and use inheritance tax planning strategies while they still exist.

Frequently Asked Questions

How much is inheritance tax in the UK in 2025?

Inheritance tax (IHT) is currently charged at 40% on the value of an estate above the nil-rate band (NRB) and residence nil-rate band (RNRB). Together, these can protect up to £500,000 per person (£1 million per couple) if a home is left to direct descendants (Simmons & Simmons, n.d.; Prestige Legal Services, 2024).

What is the inheritance tax threshold in the UK for 2025?

In 2025, the NRB remains £325,000 per person, with an additional £175,000 RNRB available if a home is passed to children or grandchildren (Simmons & Simmons, n.d.). These thresholds are frozen until at least April 2028 (Shakespeare Martineau, 2024).

Will inheritance tax change in the Autumn Budget 2025?

The Chancellor, Rachel Reeves, has signalled possible inheritance tax reforms in the Autumn Budget 2025. Speculation includes cutting the NRB to £250,000, scrapping or reducing the RNRB, restricting Business Property Relief (BPR), and raising the IHT rate to 45–50% (Streets Chartered Accountants, 2024; SW Group, 2024).

How can I reduce inheritance tax legally in the UK?

Popular estate planning strategies include:

- Using the NRB and RNRB allowances in full.

- Leveraging Business Property Relief to protect family businesses.

- Making lifetime gifts (currently exempt if you survive 7 years).

- Setting up trusts or family investment companies.

- Taking out life insurance policies in trust to cover future tax liabilities (GOV.UK, 2024a; Hurst Accountants, 2024).

What happens to family businesses under inheritance tax rules Currently, most trading businesses qualify for 100% BPR, meaning they can be passed on without inheritance tax (GOV.UK, 2024a). However, from April 2026, only the first £1 million of business assets will receive full relief; anything above that will get 50% relief (Simmons & Simmons, n.d.).

Could lifetime gifts become taxable? Yes. Proposals suggest capping lifetime gifts at £100,000–£200,000, extending the exemption period to 10–14 years, or taxing all gifts immediately. No final decision has been announced, but changes may come in the Autumn Budget 2025 (Clarke Wright, 2024; Shakespeare Martineau, 2024).

References

Bishop Fleming (2024) Inheritance tax update. Available at: https://www.bishopfleming.co.uk (Accessed: 17 September 2025).

Clarke Wright (2024) Inheritance tax receipts hit record high. Available at: https://www.clarkewright.co.uk (Accessed: 17 September 2025).

Commons Library (2024) Business Property Relief debate briefing. Available at: https://commonslibrary.parliament.uk (Accessed: 17 September 2025).

Economics Observatory (2023) How many people pay inheritance tax?. Available at: https://www.economicsobservatory.com (Accessed: 17 September 2025).

GOV.UK (2024a) Business Relief: Inheritance Tax. Available at: https://www.gov.uk (Accessed: 17 September 2025).

Hurst Accountants (2024) Inheritance tax planning update. Available at: https://www.hurst.co.uk (Accessed: 17 September 2025).

Prestige Legal Services (2024) Inheritance tax explained. Available at: https://www.prestigelegalservices.co.uk (Accessed: 17 September 2025).

Shakespeare Martineau (2024) Inheritance tax thresholds freeze extended. Available at: https://www.shma.co.uk (Accessed: 17 September 2025).

Simmons & Simmons (n.d.) Inheritance tax rules overview. Available at: https://www.simmons-simmons.com (Accessed: 17 September 2025).

Streets Chartered Accountants (2024) Budget 2025 speculation: inheritance tax. Available at: https://www.streets.uk (Accessed: 17 September 2025).

SW Group (2024) Residence nil-rate band under review. Available at: https://www.swgroup.com (Accessed: 17 September 2025).